How to apply for Credit cards online in Dinhata, Koch Bihar, West Bengal, India?

September 16, 2023| Financial Services| Dinhata

Applying for a credit card online in Dinhata, KochBihar, West Bengal, India, generally involves similar steps as in the rest of the country. Below is a detailed step-by-step guide on how to apply for credit cards online.

1. Check your eligibility:

Before applying for a credit card, make sure you meet the basic eligibility criteria set by the issuing banks. Common requirements include:

- Age: Typically between 21-60 years for working individuals, while some cards may allow 18+ years for students.

- Citizenship/Residency: Citizenship or legal residency in India is necessary.

- Employment: Regular employment or steady source of income.

- Income: Most banks require a minimum monthly or annual income.

- Credit history: A good credit score and credit history will improve your chances of approval.

2. Compare credit cards:

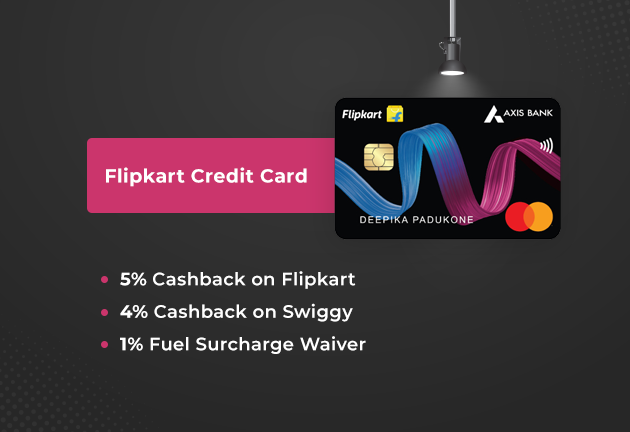

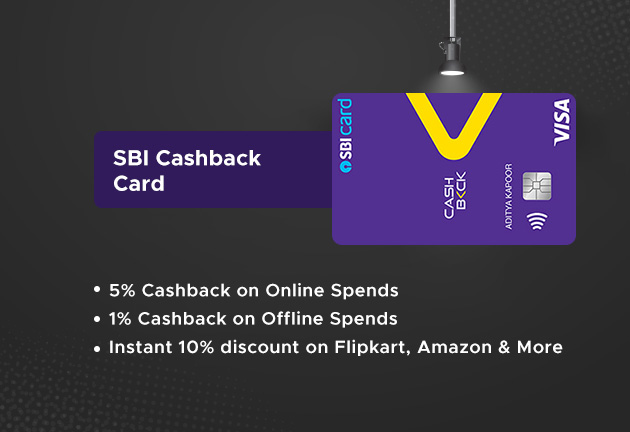

Research and compare credit cards from various banks to find the one that suits your needs, preferences, and credit profile. Consider factors such as:

- – Annual fees

- – Interest rates

- – Reward points or cashback

- – Travel and shopping privileges

- – Co-branded benefits

- – Insurance or other benefits

3. Gather required documents:

Prepare digital copies of the necessary documents, which typically include:

- – Identity proof (PAN card, Aadhaar card, Passport, or Voter ID)

- – Address proof (Aadhaar card, Passport, Utility bills, or Rental agreement)

- – Income proof (Salary slips, Form 16, Income Tax Return)

- – Bank statements (last 3-6 months)

- – Passport-sized photographs

4. Visit the bank’s website or an aggregator website:

You can apply for a credit card either through the bank’s website or an aggregator website, which allows you to compare and apply for multiple bank cards. Start the application process by filling in the required information.

5. Complete the application form:

Fill out the online application form with your personal, employment, and financial details. Double-check your information for accuracy, and upload the necessary documents.

6. Review and submit the application:

Carefully review all the details you’ve entered, and submit your application.

7. OTP verification and reference number:

After submitting the application, you’ll usually receive a One-Time Password (OTP) on your registered mobile number. Enter the OTP for verification. You’ll also receive a reference number for tracking your application status.

8. Background check and credit history review:

The bank will conduct a background check on your information, and assess your credit score and credit history to determine your creditworthiness.

9. Physical document verification (if required):

Some banks may send a representative to verify your physical documents or ask you to visit the nearest bank branch for in-person verification.

10. Approval and dispatch:

If your application is approved, the bank will send your new credit card via mail to your registered address. It may take about 7-21 days to receive your card, depending on the bank’s processing time.

11. Activation:

Follow the bank’s instructions to activate your new credit card. This may involve calling a phone number, visiting the bank’s website, or using an ATM to complete the activation process.

Remember that approval depends on factors such as your credit score, credit history, income, and the bank’s internal criteria. Make sure to compare cards, read the terms and conditions, and understand the fees and charges before applying.

Apply for Credit Cards

Credit cards apply Dinhata Credit cards Koch Bihar Credit cards online in Dinhata

Last modified: September 19, 2023